The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- The 411 on the Safe Harbor 401(k)

The 411 on the Safe Harbor 401(k)

Actually selecting and administering a plan that is right for your specific business, however, may be a bit confusing. With different options and government regulations to follow, it can be overwhelming.

In this article, we are going to break down the differences between a traditional 401(k) and a safe harbor 401(k) and help you determine which is best for your business. We’ll also be doing a deep dive on the safe harbor 401(k) in our free webinar, Maximize Your Retirement and Tax Savings in 2019, on Thursday, August 22nd.

How to Choose

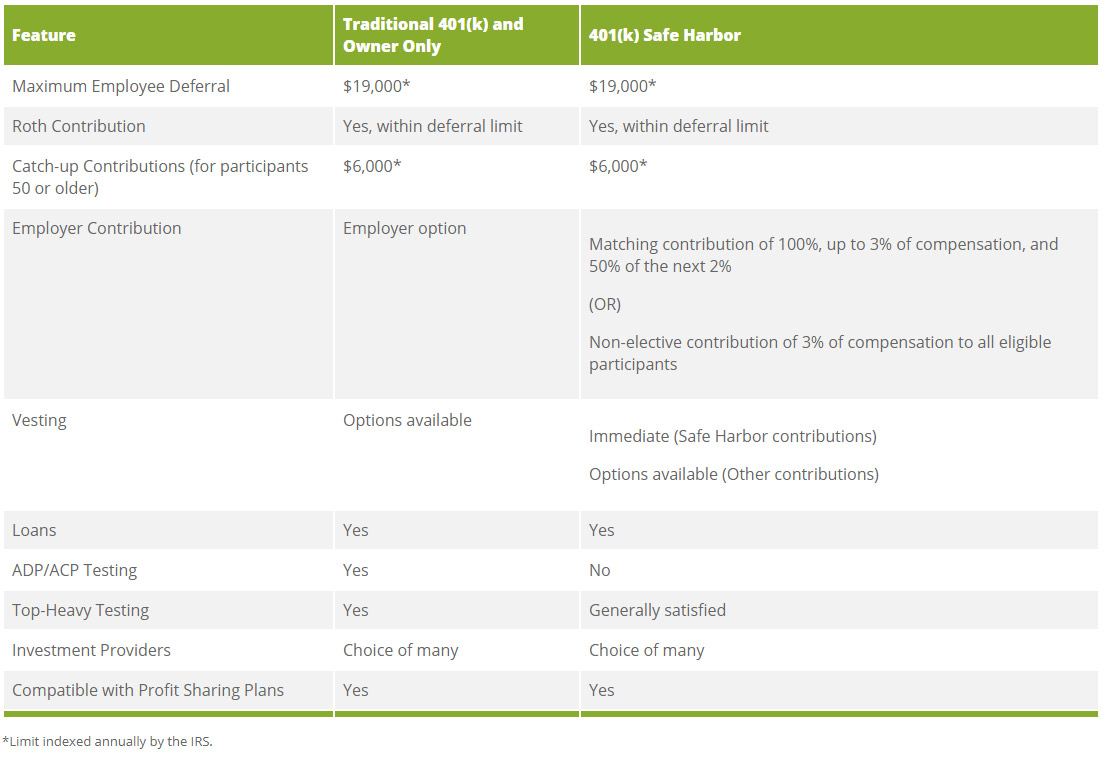

Depending on your business, it may make sense to stick with a traditional 401(k) over a safe harbor 401(k), or vice versa. While both are retirement options that lead to tax savings and employee satisfaction, there are a few differences you’ll want to consider. The biggest differences between these plans fall into three areas: contributions, vesting, and testing.

Interested in the Safe Harbor 401(k)?

As you consider what plan is right for you and your small business, there is one more thing to know about the safe harbor 401(k) that may be enticing. If you have less than 100 employees and this is your first plan, you may qualify for tax credits up to $1,500, which breaks down to $500 per year over 3 years. Because setting up a plan can be time-consuming and costly, this benefit is meant to offset the costs you incur while setting up the plan.

Next Steps

The reason for all of the focus on the safe harbor 401(k) plan right now, is the deadline to switch to the plan is fast approaching on October 1. If you find yourself still confused about what to do, don’t forget to sign up for our free safe harbor 401(k) webinar on August 22nd.

If you are interested in speaking to someone to secure a safe harbor 401(k) plan for your business, please call us at 866-497-2028.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.