The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- Tax Forms for Independent Contractors

Tax Forms for Independent Contractors

With small business owners increasingly relying on independent contractors to fill a void within their company, it’s important to garner knowledge of the tax implications. However, when choosing to employ independent contractors, it’s important to note that there are payroll and tax requirements that differ from full-time employees.

The IRS defines independent contractors as follows:

“The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.”

In our blog post on employees and contractors we explained the three key differences between the two groups: behavioral control, financial control, and type of relationship. If you set hours, pay a specific amount on a planned schedule, and have an understanding of a long term relationship, you have an employee. If you have somebody who does the work on their schedule, receive a fee per project or have a short-term arrangement, you are likely dealing with a contractor.

Tax Forms for Independent Contractors

Independent contractors have different tax implications than employees, thus requiring the use of a unique set of tax forms, including:

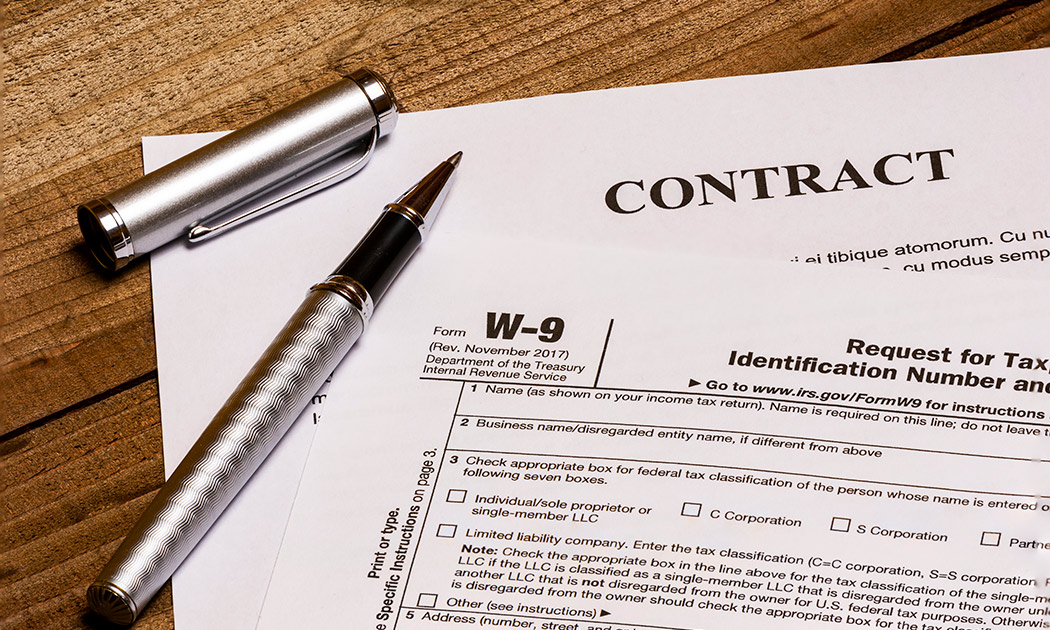

- Form W-9: Upon engaging the services of an independent contractor, formalize the services via a contract and request that the individual complete Form W-9.

- Form 1099-MISC: If you pay more than $600 in a year to a contractor, you’re required to provide a 1099-MISC for tax reporting purposes.

- Form 1096: This is a summary report of the informational returns filed by a company. It’s filed with the IRS, but a copy is not provided to contractors.

State Requirements for Independent Contractors

In addition to federal requirements, your state may have its own requirements for independent contractors.

For example, if you’re located in California, you’re required to report contractor information to the state’s Employment Development Department (EDD). This includes information such as:

- Taxpayer identification number

- Employer account number

- Contractor’s name and Social Security number

- Date when you reached $600 in payments to the contractor

- Amount of money paid

- Contract expiration date

Misclassification is a Big Deal

Purposely or mistakenly misclassifying an employee as an independent contractor is a big deal, as you may be held liable for employment taxes for that worker.

In addition to the requirement to pay back taxes, the IRS can seek a criminal conviction should they believe the misclassification was intentional. This can result in up to a year in jail, along with a maximum fine of $500,000.

If you have questions about how to classify a worker, this chart shared by the U.S. Department of Health & Human Services should provide clarity.

Final Thoughts

With approximately 36 percent of U.S. workers partaking in the gig economy, you should have procedures in place to identify independent contractors and ensure compliance with all tax reporting requirements.

Knowledge of tax forms for independent contractors will help you better manage your company while avoiding future complications. Understanding the forms you need upfront will also help managing payroll and taxes a bit easier.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.