The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- How Much Federal Tax is Taken Out of my Paycheck

How Much Federal Tax is Taken Out of My Paycheck?

A common question new employees ask is, “How much federal tax is taken out of my paycheck?” While everyone knows taxes affect take-home pay, it can be hard to understand how much it affects it.

As a small business owner, understanding how taxes affect payroll is essential to you and your employees.In this post, we’ll tackle:

What are Federal Taxes?

How Do You Calculate Your Federal Income Tax?

What are Federal Taxes?

Federal taxes are the taxes withheld from employee paychecks. These taxes fall into two groups: Federal Income Tax (FIT) and Federal Insurance Contributions Act (FICA). Federal Unemployment Tax Act (FUTA) is another type of tax withheld; however, FUTA is paid solely by employers.

For employees, there isn’t a one-size-fits-all answer to, “How much federal tax is taken out of my paycheck?” However, free online tax calculators and learning how payroll taxes work helps understand what take-home pay may look like.

How Do You Calculate Your Federal Income Tax?

When it comes to Federal Income Tax (FIT), there are a few factors that determine your Federal Income Tax rate.

1. What is My Filing Status?

The filing status you use largely depends on the answer to one question: Were you considered married on the last day of the year? If yes, you are considered married for tax filing that year. If not, you are considered not married.

Some particular circumstances under which married persons may be viewed as not married. For example, someone may qualify for Head of Household status even if they are not legally separated or divorced.

Types of filing statuses include:

- Single Filing Status: This status should be used by people who are considered unmarried on the last day of the year. If you are single and claiming a dependent, you may be eligible for Head of Household filing status.

- Head of Household Filing Status:

If you are unmarried, paid more than half the costs of keeping up a home, and have a Qualifying Person, you may qualify for Head of Household filing status.

This filing status provides a higher standard deduction and lower tax rate than the Single filing status. Qualifying for Head of Household requires meeting strict criteria, and only certain closely-related dependents will qualify for Head of Household filing status.

Under certain circumstances, a married person may also qualify for Head of Household. For example, if the married person is claiming a qualifying dependent and living separately from their spouse for the final six months of the year or longer, they would qualify as Head of Household.

- Qualifying Widow/Widower with Dependent Child Filing Status:

If you are now unmarried due to the loss of your spouse within the year, you may still file jointly or separately as a married person for that year, regardless of whether you have a dependent.

You can file under the Qualifying Widow/Widower with Dependent Child filing status after the initial year of death if you remain unmarried and have a dependent child. This allows you to continue benefiting from the same standard deduction and federal tax rates for married couples filing jointly. This status can be claimed for a total of two years. At that point, if you remain unmarried, your filing status will need to change to Single or Head of Household, depending on whether you still claim a child dependent.

If you remarry following the two-year Qualifying Widow/Widower with Dependent Child Filing Status eligibility period, you should file using one of the married filing statuses.

- Married Filing Jointly Status: You may choose to file jointly with or separately from your spouse as a married person. A joint tax return combines the incomes and deductions of both spouses. To file jointly, both spouses must agree to file a joint return, and both must sign the return before filing. Married Filing Jointly offers more federal tax benefits than Married Filing Separately, though there are reasons you might choose the latter over the former.

- Married Filing Separately Status:

Married Filing Separately filers receive the least tax benefits but are responsible for separate tax liabilities or penalties. Consult an accountant or tax professional to determine which married filing status will provide the best benefit for your specific financial situation.

Here are a few reasons a couple may choose to file separately:

- Only one spouse wants to file taxes

- One spouse suspects that the information on the joint return might not be correct

-

- One spouse doesn't want to be liable for the payment of tax due on the joint return

- One spouse owes taxes, and the other is due a refund

- The spouses are separated, but not yet divorced, and want to keep their finances separate

2. How Does Income Affect Your Filing Status?

The amount of money you earn during your pay period – when viewed with your filing status – determines your income bracket and associated federal income tax rate. For 2022 tax brackets, visit this page from the IRS.

3. Does My IRA or 401(k) Change My Filing Status?

Your taxes may also be impacted if you contribute a portion of your paycheck to a tax-advantaged retirement savings account. Eligible plan types include traditional IRAs and 401(k)s. Contributions to these plans are considered pre-tax and are therefore exempt from federal income tax during the year in which you make the contribution. It’s important to note that there are limits to the pre-tax contribution amounts. For 2022, the limit for 401(k) plans is $20,500. For those age 50 or older, the limit is $27,000, allowing for $6,500 in “catch-up” contributions.

What are FICA Taxes?

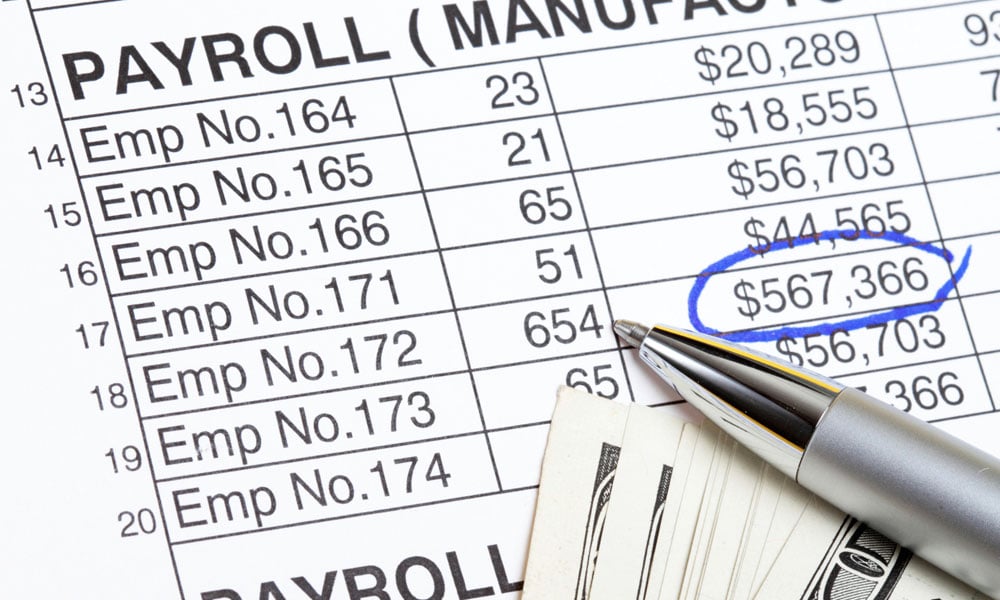

FICA taxes are commonly called “the payroll” tax; however, they don’t include all taxes related to payroll. FICA taxes consist of Social Security and Medicare taxes. These amounts are paid by both employees and employers. For 2022, employees will pay 6.2% in Social Security on the first $147,000 of wages. The Medicare tax rate is 1.45%.

What Do Small Business Owners Need to Know About Taxes?

All of the information above can apply to both business owners and employees. But as a small business owner, employees may ask you, “How much federal tax is taken out of my paycheck?” Now, you’ll have a better understanding of the process. This will also help you understand questions about your own paychecks.

Be sure to get Form W-4 from employees during onboarding if you run the payroll on your own. Additionally, have employees verify their personal information is correct at the end of the year as you’re preparing Form W-2 for tax season.

From there, payroll calculators will be your friend to help you calculate payroll for salaried employees and contractors.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.