The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- How Do I Calculate Payroll Taxes?

How to Calculate Unemployment Tax Withholding

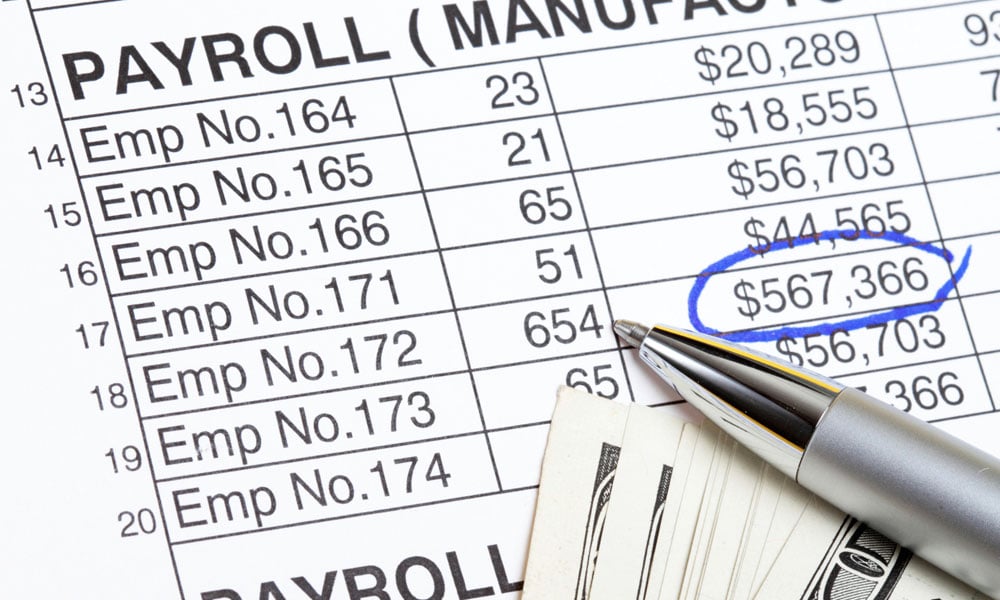

What are payroll taxes? Payroll taxes are federal, state and local taxes withheld from an employee's paycheck by the employer.

These taxes consist of income taxes, unemployment taxes, and deductions for Social Security and Medicare taxes, the last of which are often referred to as "the payroll tax." Setting aside income taxes for the moment, we are going to focus on unemployment taxes, Social Security, and Medicare to start.

FUTA, SUTA/SUI, and FICA—Oh my!

When it comes to understanding payroll tax requirements at the federal, state, and local levels, you’re going to need to get comfortable with a few commonly used acronyms:

- Federal Unemployment Tax Act (FUTA): this is a payroll tax that goes into a fund used at the federal level to oversee state unemployment insurance programs. If a state is experiencing a period of high unemployment and struggling to pay out benefits, they may borrow money from this federal unemployment fund, for example.

- State Unemployment Tax Act (SUTA): this is a payroll tax collected by your state to fund unemployment insurance benefits to workers.

- State Unemployment Insurance (SUI): this provides benefits in the form of money to people who have lost their jobs (there are additional requirements to collect SUI, including that you have lost the job through no fault of your own and are actively pursuing new employment). These benefits are funded primarily through SUTA, though in some instances FUTA funds may be used.

- Federal Insurance Contributions Act (FICA): this is a federal law requiring that employers withhold specific taxes from the wages you pay your employee, namely Social Security and Medicare.

Note: For employees who make over $200,000 per year, an additional Medicare surtax is required to be withheld from payroll as part of FICA.

Who Pays Federal Unemployment Taxes?

Federal unemployment taxes are paid solely by the employer and are calculated based on an employee’s wages. To pay FUTA, you are required to submit form 940 to the IRS. Employers who pay employees who aren't household or agricultural employees and answer “yes” to either of the following are generally subject to FUTA and required to file form 940:

- Did you pay wages of $1,500 or more to employees in any calendar quarter?

- Did you have one or more employees for at least some part of a day in any 20 or more different weeks in the year? Count all full-time, part-time, and temporary employees. However, if your business is a partnership, don't count its partners.

FUTA and Household Employers

Household employers are required to pay FUTA tax on wages paid to household employees only if cash wages of $1,000 or more were paid in any calendar quarter?

In most cases, employers of household employees must file Schedule H (Form 1040) instead of Form 940.

FUTA Exemptions

Certain employers are exempt from FUTA tax, even if they meet one of the above requirements:

- Organizations with 501(c)3 status are exempt from FUTA tax.

- Household employers are not required to report cash wages paid to a spouse, a child under age 21, or a parent.

Who Pays State Unemployment Taxes?

State unemployment taxes are usually paid solely by the employer and are calculated based on an employee’s wages.

Employees in Alaska, New Jersey, and Pennsylvania are subject to state unemployment tax withholding as well. If you employ workers in any of these three states, you will be required to withhold the tax from their wages and remit these funds directly to the state.

SUTA Exemptions

Much like with FUTA, certain businesses may be exempt from paying SUTA. However, as this is a state-levied tax, the exemptions vary by state. If you believe your business is exempt from SUTA in your state, you should consult an accountant or tax professional to be sure.

Who Pays Social Security and Medicare?

Unlike FUTA and SUTA, FICA taxes that go toward Social Security and Medicare have both required employee withholding as well as an employer-paid portion. With the exception of the Medicare surtax, the Social Security and Medicare contributions are equally split between the employer and employee.

FICA Exemption

Some employees and specific wage types may be exempt from FICA taxes, including:

- Non-work income (for example, dividends paid on stocks, interest from investments, capital gains, and pensions)

- Persons employed by a foreign government

- Students employed by a school, college, or university where they are pursuing a course of study

- Certain state and local government employees

- Some nonresident aliens

- Members of certain religious groups

For a full accounting of FICA exemptions, refer to IRS Publication 963.

Payroll Taxes: How Much Are We Talking?

FUTA

The FUTA tax rate is 6.0%. FUTA applies to the first $7,000 you paid to each employee as wages during the year. This first $7,000 is often referred to as the federal or FUTA wage base.

Note: Your state wage base may be different.

If you paid wages subject to state unemployment tax, you may receive a credit when you file your Form 940. The credit maximum is 5.4%. If you are entitled to such a credit, your final FUTA tax rate would be the standard FUTA tax rate of 6.0% minus the credit.

Generally, you're entitled to the maximum credit if you paid your state unemployment taxes in full on time, and the state isn't determined to be a credit reduction state. Form 940 provides full instructions on how to determine the credit.

Note: If you are in a credit reduction state (meaning your state has borrowed FUTA funds to pay unemployment benefits but has not repaid the loan within two years), the credit you receive for state unemployment tax paid may be reduced.

SUTA

SUTA taxes do not have a standard rate. Each state sets its own rates.

When you become an employer, you will be required to register for an account with the state unemployment agency. Many states have a rate for new employers. The state agency will send you an updated rate every year; this is typically based on your industry, experience, and number of unemployment claims made by former employees.

Note: If you are using a payroll provider to process payroll and calculate and file your payroll taxes, you will need to submit your updated annual rate to the provider so they can ensure your SUTA payments are accurate for the year.

Every state also sets its own wage base. This is the maximum amount of wages per employee per year that you owe SUTA tax on (we previously covered the federal wage base of $7,000).

Note: You must pay state unemployment taxes to the states where your employees live.

FICA

The payroll tax rates and wage thresholds for FICA are subject to change, so it’s important to keep up to date with any new legislation or rate changes—when in doubt, be sure to consult your accountant or tax professional.

For 2019, the combined FICA rate for employers is 7.65%, which breaks down to 6.2% for Social Security and 1.45% for Medicare.

An employee will pay 6.2% Social Security tax on the first $132,900 in wages and 1.45% Medicare tax on the first $200,000 in wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return). Social Security deductions cease for both the employer and employee upon reaching the $132,900 wage base.

An additional 2.35% Medicare tax (1.45% base tax plus .9% surtax) is levied on wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

The Social Security wage base amount is determined on a year-by-year basis. Medicare contributions continue regardless of wages.

Income Taxes and Form W-4

As we previously mentioned, in addition to the specific payroll taxes related to FUTA, SUTA, and FICA, income taxes are also calculated and withheld from payroll for most employees (any 1099 contractor will need to report and pay self-employment tax if their net income is $600 or more).

The employer should calculate and withhold proper income taxes based on the withholding status declared by the employee—but ultimately, correct payment of income taxes is the individual employee’s responsibility and any under or overpayment of taxes will be theirs to resolve when they file their tax return.

It is best practice to have all employees complete Form W4, which declares their amount of withholding, and revisit their withholding status on an annual basis (December is a great time to do so!). Federal and state income taxes (and local income taxes where applicable) are calculated based on the employee's W-4 form.

The IRS, in turn, provides the income tax calculation based on those declarations. The employee can include more in withholdings than is required by the IRS. State taxes are determined in much the same way. Every individual state's tax board provides a calculating formula for tax withheld.

Ready…Set…Calculate Your Payroll

For help calculating anything on your own, you can calculate payroll taxes using our business calculators for help. They shouldn't be used to run payroll for your business but can help guide you when making decisions.

As you can see, calculating payroll tax is complicated—and on top of that you’ll have to ensure you’re paying and filing these taxes correctly and on time, every time. If you’re overwhelmed an online payroll provider or accountant can help you calculate payroll taxes and remain compliant.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.