The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- Is It Illegal to Pay Employees Cash?

Paying Employees Cash and How to Do It Legally

If you’re starting a new business and wondering how to pay employees in the most efficient way possible, your mind may immediately jump to cash.

While cash may be king, it’s not the ideal method for payroll. Even though paying employees in cash may be the easiest and fastest way to distribute payment, payroll errors can lead to penalties with a variety of enforcement agencies including the IRS and DOL.

Is It Illegal to Pay Employees Cash?

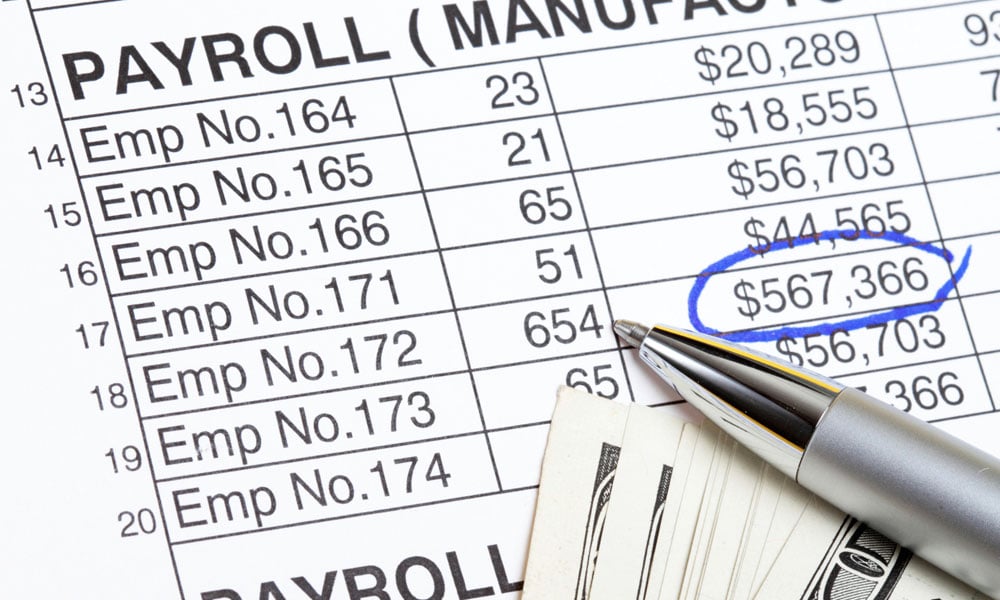

It is not illegal to pay individuals in cash, however, there are several downfalls generally associated with this business practice. It may complicate the process of paying the accurate amount of payroll taxes. The term “under the table” is used when employers pay employees cash and do not deduct the necessary payroll taxes. Cash wages need to be treated like any other wages, which is why if you aren’t withholding payroll taxes, you could land in hot water with the IRS.

Potential Pitfalls of Paying Employees in Cash

Every small business operates differently. Therefore, if you want to use cash to pay employees, you can, but there are some considerations you’ll want to keep in mind.

- Wage statements. Wage statements are required in many jurisdictions regardless of the method of payment. Although wage statements can be provided if an employer pays in cash, they are often forgotten. Large penalties can be assessed per employee and per pay period if wage statements are not issued.

- Proof of payment. Many jurisdictions require proof of payment on payday and checks are often the easiest way to show this. Employers who pay cash may wish to get signed receipts from employees that received the payment.

- Easier to make payroll mistakes. There can be some added complexity if you’re using cash. Important payroll taxes can easily be miscalculated, or not paid at all, and it’s harder to fix mistakes when you’re using paper money.

- Tax issues. Building on the last point, ongoing payroll mistakes can be a red flag to enforcement agencies. Even if you make an honest mistake, you can face the consequences ranging from fines to audits to imprisonment in the most extreme cases.

- Negative consequences for employees. While in the short term your employee may be thrilled to receive cash, over time it can negatively impact them due to the lack of an official paper trail.

- Lack of funding options. When you don’t have a formal payroll set up, it can be challenging to get loans and other funding when you find yourself in a pinch.

How to Pay Employees Cash Correctly

Now that you’re aware of the pitfalls of cash wages, if you still want to proceed, here are some important things to consider so that you can remain compliant.

- Understand payroll tax requirements. Payroll can be a daunting task because of the different tax requirements that exist. You are responsible for understanding FICA taxes, unemployment, and federal and/or state income taxes (depending on which state you live in). When paying cash wages, ensure that you’re properly withholding and paying the correct amount of payroll taxes.

- Understand wage and hour requirements. These impact how much employees must be paid and what time is considered compensatory.

- Keep accurate records. Staying on top of your records is a general good business practice, but it becomes essential when paying cash. Keep track of the wages paid, the payroll taxes withheld, and when you paid your employee. Having a strong system in place will keep you covered should any problems with an enforcement agency arise.

- Follow similar practices for employees and independent contractors. Even though independent contractors operate differently than employees, if you’re going to pay cash to contractors, it’s important you are following the similar practices as mentioned above for employees. Contractor payments must be reported to the IRS. To report independent contractor wages, use Form 1099-MISC to report wages annually and verify a taxpayer ID for independent contractors.

Bottom Line

Again, while it may not be illegal to pay employees cash, you may be taking on more risk than it’s worth. For an easier time processing payroll, you can turn to an accountant or bookkeeper or an online payroll service to help you out. Those options will help ensure that you are accurately following government guidelines to remain in compliance and that your employees receive accurate paychecks.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.