The Payroll Blog

News, tips, and advice for small business owners

- Home

- Resources

- Payroll Blog

- Small Business Owners Guide to 401K

Small Business Owners Guide to 401K

As a small business owner, you might be thinking about the best way to save for your retirement, as well as your employees. Only half of all Americans are set to meet their retirement saving goals—the earlier you start planning, the better.

There are several retirement options available, and it can be confusing to know which plan makes the most sense for you, and your business. Offering a 401(k) plan to your employees is a great thing to consider because it shows employees that you are invested in them, and in the long run can boost employee engagement. Below, you'll learn more about how to set up a 401(k), the different 401(k) plans that you can choose, and the benefits and drawbacks of each.

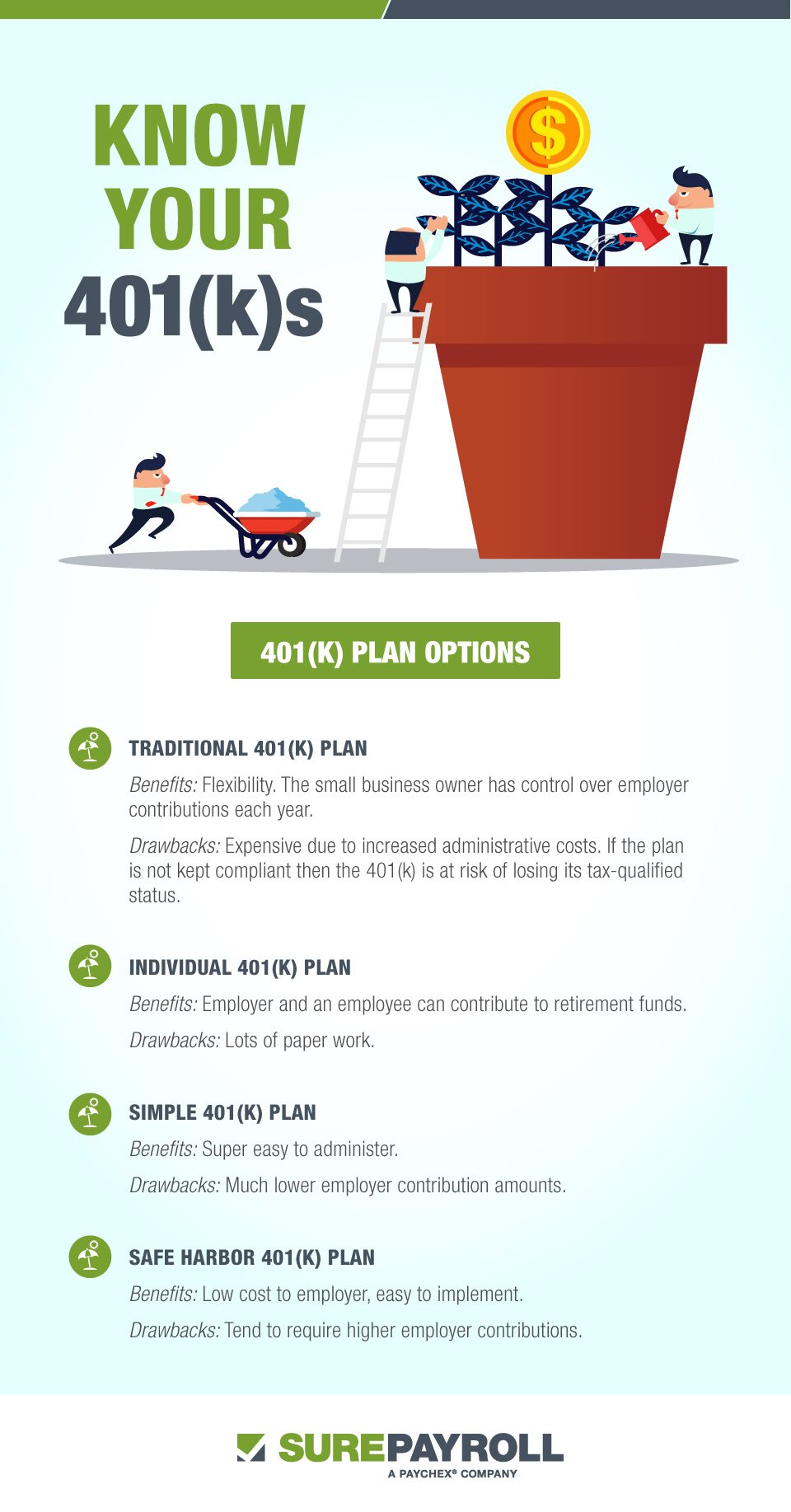

401(k) Plan Options

The best 401(k) for small business is going to vary depending on the type of small business you have. Every plan is different and small business owners need to determine which plan fits their needs best. The plans covered in this guide are the traditional 401(k) plan, the individual 401(k) plan, the simple 401(k) plan, and the safe harbor 401(k) plan.

While there are different aspects of each plan, all 401(k) plans let participants make salary deductions to contribute to their 401(k) account.

Traditional 401(k) Plan

Traditional 401(k) plans are employer-sponsored which gives employees a variety of investment options. With the traditional 401(k) plan, the employer must decide whether to match your employee's contribution, contribute a percentage of income to each employee (a nonelective contribution) or to do both. With a traditional 401(k) plan come several administrative costs associated with it as well as testing requirements.

Benefits

If flexibility is what you're looking for, this is the plan for you. The traditional 401(k) plans allows the small business owner to change the amount of employer contributions every year. For example, if business is slow one year then the small business owner can choose to decrease employee contributions to compensate.

Drawbacks

Because traditional 401(k) plans are subject to rigorous testing, they tend to be more expensive due to increased administrative costs. If the plan is not kept compliant then the 401(k) is at risk of losing its tax-qualified status.

Individual 401(k) Plan

The individual 401(k) plans, also known as solo or self-employed, is similar to the traditional 401(k) plan. However, this plan is designed exclusively for sole proprietors or partners who do not have common-law employees.

Benefits

As a small business owner, the benefits are numerous—individual 401(k) plans allow you to contribute retirement savings as an employer and an employee. This lets you contribute more towards your retirement savings than would be possible with another plan.

Drawbacks

If you plan on hiring employees and growing your company, you will have to transition to another 401(k) plan. An additional drawback includes the responsibility of paperwork, which must be filed by the administrator of the plan.

Simple 401(k) Plan

Unlike the traditional 401(k) plan, eligibility is dependent on whether or not your business has less than 100 employees who have been compensated at least $5,000 within the previous year. According to Investopedia, the simple 401(k) plan is a blend of a simple IRA and a traditional 401(k) plan because it offers features that appear in both plans.

Benefits

The simple 401(k) plan is easy to administer and put in place. Unlike the traditional 401(k) plan, you will not be required to undergo top-heavy and non-discrimination testing which cuts out a lot of paperwork and expense.

Drawbacks

If you planned to save aggressively for your retirement, the simple 401(k) can throw a wrench in your plans—the amount that can be contributed is lower than a traditional 401(k). In addition to a lower contribution amount, the employee is entitled to all of the funds in their simple 401(k) plan straightaway—this is referred to as immediate vesting.

Safe Harbor 401(k) Plan

Like the simple 401(k) plan, a safe harbor 401(k) plan does not need to undergo testing. The safe harbor 401(k) plan enables employees to contribute a percentage of their salary with each paycheck in addition to employer contributions. According to the U.S. Department of Labor, employer contributions are 100 percent vested.

Benefits

As long as certain conditions are met, this plan does not require the same testing requirements as a traditional 401(k). This eases complicated administrative requirements and costs for the business owner.

Drawbacks

Contributions made to a safe harbor 401(k) plan may be higher than that of other 401(k) plans. While this may not be a major concern for businesses with a steady stream of income, it might not be the right choice for a newer business.

Why a 401(k) is a Smart Decision

Saving for retirement is important and a 401(k) affords small-business owners a path to retirement. In addition to helping small-business owners save for retirement, 401(k) plans are important to employees as well. 401(k) plans place second only to health benefits, according to a recent Harris Interactive survey. As a small business, it is imperative to stay competitive by providing incentives that will attract high-quality employees.

While 401(k) plans allow you to contribute pre-tax dollars to your retirement account, unless you've opted for a Roth 401(k) option, they also let you qualify for tax breaks. If you are a small-business owner starting a 401(k) for the first time, you can qualify for a $500 tax credit for each of the first three years of your plan.

How to Set Up 401(k) For Small Business

If you're convinced of the benefits of a 401(k) plan then the first question to is:

Will you set up the plan yourself or will you consult with an expert advisor or a relevant financial institution, such as a bank or insurance company?

Once you have figured this out, and know which plan you want to move forward with, there are several basic steps you need to take. You will need to:

- Adopt a written plan.

- Create a trust for the 401(k) plan's assets.

- Establish a recordkeeping system.

- Develop a plan with information for eligible employees.

Setting up a 401(k) for small business does not have to be an intimidating venture for small business owners. Working with an accountant or in some cases, an online payroll service can help you get the 401(k) plan you need.

Related Blog Posts

View Our Plans and Pricing

Small Business Is Our Business.

This website contains articles posted for informational and educational value. SurePayroll is not responsible for information contained within any of these materials. Any opinions expressed within materials are not necessarily the opinion of, or supported by, SurePayroll. The information in these materials should not be considered legal or accounting advice, and it should not substitute for legal, accounting, and other professional advice where the facts and circumstances warrant. If you require legal or accounting advice or need other professional assistance, you should always consult your licensed attorney, accountant or other tax professional to discuss your particular facts, circumstances and business needs.